Patents provide the owner thereof the right to exclude others from practicing the patented invention for a limited period of time. In exchange for this right, a patent applicant must demonstrate that the invention is a significant contribution to the relevant state of the art, and the patent application must publicly disclose the invention in a detailed manner. This quid pro quo, a limited right to exclude in exchange for full public disclosure, has served to foster innovation for hundreds of years.

For example, Satoshi Nakamoto, the pseudonym for the unknown inventor(s) of bitcoin, leveraged patented cryptographic “Merkle Trees” in a new manner to create bitcoin and the undelaying technology known as “blockchain”. Merkle Trees, invented by Ralph Merkle, are a mechanism for cryptographically linking and securing blocks of data, a fundamental component of blockchain technology. The Merkle Tree patent had expired by the time Satoshi created bitcoin, so Satoshi was free to use Merkle Trees. Stanford University, Merkle’s employer at the time and the owner of the Merkle Tree patent, likely would not have funded Merkle’s research and allowed public disclosure of the details of Merkle Trees without the reward of the limited right to exclude others that the patent afforded. On the other hand, if the right to exclude was not limited in time, blockchain innovators would be excluded from using Merkle Trees and effectively blockchain would be owned by Stanford University. As it is, innovation in blockchain, and related technologies, is happening at a furious rate.

However, patents are a property right that can be purchased in a manner similar to any other property, such as real estate or a business entity. Therefore, the owner of a patent need not be the innovator. Further, in most countries, there is no obligation to make, or allow others to make, the patented invention. This decoupling of patent ownership from the innovator has permitted a business model known as the “Patent Assertion Entity” (PAE), sometimes referred to as a “Patent Troll”. PAEs ordinarily purchase patents from the innovators and assert the patents for licensing revenue. This can present a significant obstacle to startups that cannot afford the high cost of royalties or patent litigation.

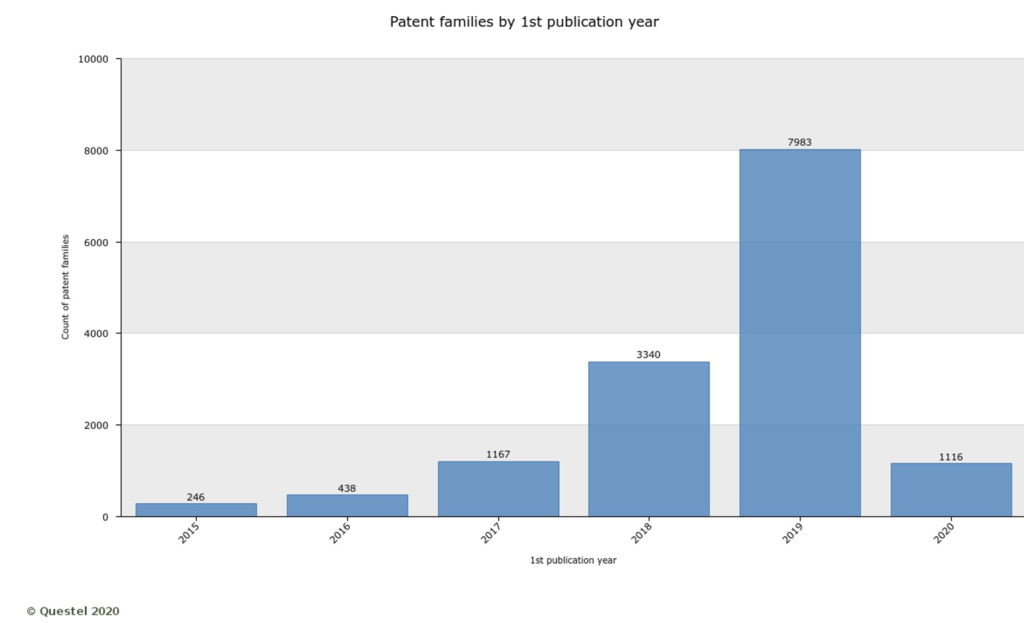

Much blockchain technology is based on open source software, such as bitcoin or Ethereum blockchain protocols. However, this does not prevent patent owners from asserting their patents against participants in blockchain ecosystems when the implementation is believed to infringe the patent. Further, many parties are seeking patent protection for various implementations of blockchain technology at an ever increasing rate as shown in FIGURE 1 which illustrates worldwide published patent families by year. As of February 10, 2020, there are almost 15,000 published patent families. [1]

FIGURE 1

These patents are being sought in the all of the major world markets including the U.S., the E.U, China, Australia, and Japan. Blockchain innovation, based on original patent filings, is concentrated largely in the U.S. and China. With the number of patents originating in China almost doubling the number of U.S. originated patents in the last two years.

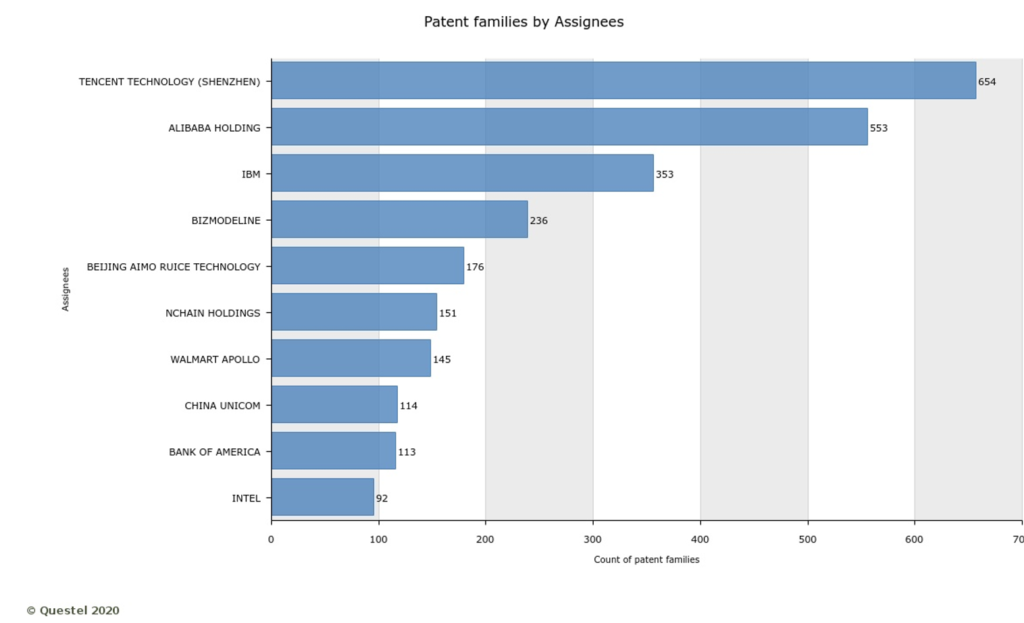

It is noteworthy that patents related to blockchain technology are being sought by various players including, large technology companies, financial services companies, retailers, government entities, and fintech companies, as shown in FIGURE 2 illustrating the top 10 owners of blockchain patents.

FIGURE 2

This is a very diverse group of players all vying for market position in a developing, but very promising, technology space. While financial services companies seem to have had a culture of détente with respect to patents of the last several years, the other players in this space have no such culture. Players in this space are likely to use aggressive tactics to stake out a claim to new markets, including patent assertions. Further, while the largest patent owners are mostly very large entities, about 80 percent of the patents in this space are owned by parties, mostly startups, that have only a small number of patents. Many of these players will not succeed and could be a fruitful source of patent assets to PAEs. Like other quickly growing technology spaces (e.g. web technologies and mobile communications) we are likely to see excessive patent litigation, both from PAEs and competitors, related to new applications of blockchain technology.

Patent litigation is expensive and time consuming and thus is a very inefficient pricing mechanism for patent royalties. If the patent landscape related to blockchain technology is not managed properly, blockchain innovators are likely to to pay hundreds of millions of dollars in patent litigation costs, damages, and royalties.

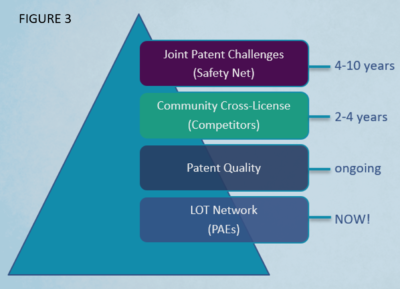

The “Community Patent Protocol” (CPP) is a framework for managing patent risk related to blockchain technology. FIGURE 3 illustrates the components of the CPP. LOT Network, a community for eliminating the risk presented by PAEs, is the foundation of the framework. Patent Quality, including educating patent examiners on blockchain technology and relevant making non patent prior readily available to patent examiners is ongoing and a critical element. The Community Cross License is a patent pool that will allow patent owners to be rewarded for their innovation while providing freedom to operate in the space. Finally, a mechanism for joint patent challenges, such as the Unified Patents model, will be required in the future as a safety mechanism against poor quality patents that slip trough the cracks.

The “Community Patent Protocol” (CPP) is a framework for managing patent risk related to blockchain technology. FIGURE 3 illustrates the components of the CPP. LOT Network, a community for eliminating the risk presented by PAEs, is the foundation of the framework. Patent Quality, including educating patent examiners on blockchain technology and relevant making non patent prior readily available to patent examiners is ongoing and a critical element. The Community Cross License is a patent pool that will allow patent owners to be rewarded for their innovation while providing freedom to operate in the space. Finally, a mechanism for joint patent challenges, such as the Unified Patents model, will be required in the future as a safety mechanism against poor quality patents that slip trough the cracks.

The CPP is a tapestry of community efforts that will provide an efficient marketplace for patent royalties, thus rewarding patent owners and providing innovators freedom to operate. Details of the CPP will be the subject of future articles. The blockchain community must come together now and participate to establish a culture of technical competition and innovation without the tax burden of excessive litigation.

[1] The patent statistics presented herein are based on a search of worldwide patent publications conducted on February 10, 2020.

Marc Kaufman is an intellectual property attorney based in Washington, DC. Marc concentrates his practice on patent strategy in the technology areas of Fintech, database technology, content distribution, and computer security (rimonlaw.com/team/marc-kaufman). Over the last several years, Marc has actively monitored and analyzed the emerging patent landscape related to blockchain technology and cryptocurrency.

Marc Kaufman is an intellectual property attorney based in Washington, DC. Marc concentrates his practice on patent strategy in the technology areas of Fintech, database technology, content distribution, and computer security (rimonlaw.com/team/marc-kaufman). Over the last several years, Marc has actively monitored and analyzed the emerging patent landscape related to blockchain technology and cryptocurrency.

Marc is a co-founder of the Blockchain IP Council, an initiative of the Chamber of Digital Commerce focused on managing intellectual property issues related to blockchain technology. Marc has spoken throughout the world, including at the World Trade Organization, the European Union Intellectual Property Office and the U.S. Patent and Trademark Office, authored many articles, and been quoted in notable publications such as the New York Times, the Boston Globe, Forbes, Newsweek, and the Patent Trademark & Copyright Journal. Marc has been named to the IAM 350 Top Patent Strategists every year since its inception.