To analyse the potential risk from NPEs in this area, we can use Cipher’s Universal Technology Taxonomy (UTT) which classifies every patent available into one of over 120 technology classes. This contains six classes relevant to sustainable and alternative energy: Batteries; Photovoltaics; Nuclear; Hydroelectric; Fuel Cells; and Wind Turbines. While this doesn’t include an analysis of sustainable technology areas such as Biofuels, it still provides a snapshot of NPE interest in sustainable energy technologies.

Key findings

- NPEs have the highest number of patents in the sustainable energy fields of Nuclear, Batteries, and Photovoltaics.

- The total number of active families owned by NPEs have generally decreased over the last 20 years, suggesting difficulty monetizing these portfolios.

- There has recently been a spree of litigations by NPEs against small companies in the sustainable energy industry, which could stifle innovation and slow the energy transition.

Landscape Overview

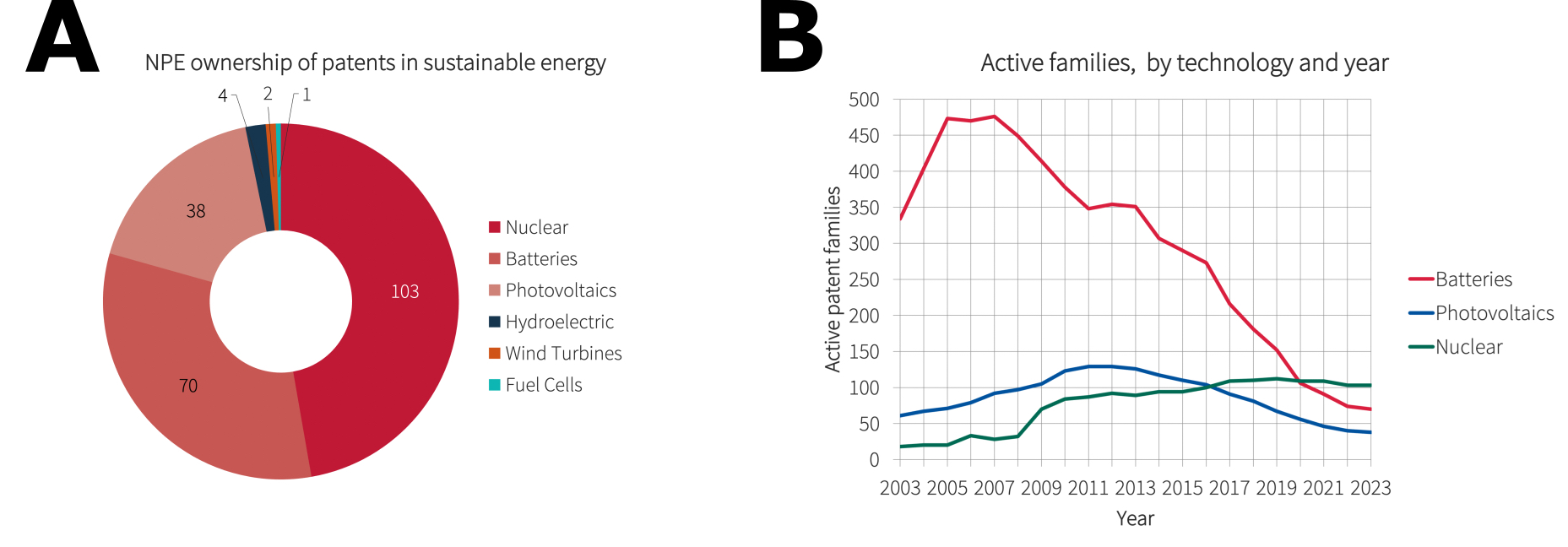

The number of active patents in each of the six sustainability classes covered by UTT are not evenly distributed (A). NPE activity is highest in Nuclear, Batteries, and Photovoltaics, whereas there are very few families in the Hydroelectric, Wind Turbine, and Fuel Cells classes. Focussing on the three technologies with the highest activity, we can take a further look at patenting activity over the last twenty years (B). While the number of active families owned by NPEs in the field of nuclear energy have gradually increased over the last twenty years, Batteries and Photovoltaics have seen a decrease in activity. This is most pronounced with the Batteries class, which has seen a drop from over 450 active families in 2007 to only 70 today. This suggests that on the whole, NPEs have been letting go of their families in the sustainable energy area, which may indicate that there has been difficulty monetising these portfolios through licensing or litigation.

Graph titles: (A) Donut chart showing the number of active families owned by NPEs in six sustainable energy technology classes. (B) Graph showing the change in the number of active families owned by NPEs over the last 20 years in three sustainable energy technologies.

Which NPEs own the patents in sustainable energy?

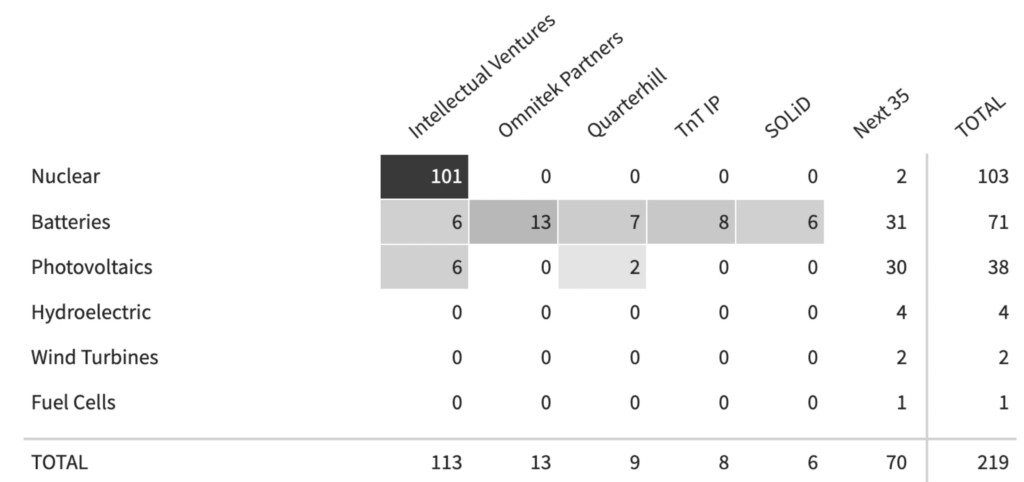

While these technology-based trends are interesting, who are the NPEs who pose the greatest risk to organizations investing in sustainable energy (Fig. 1C)? Over half of the active families found in this analysis belong to Intellectual Ventures, and the vast majority fall into the nuclear technology class. While this may be surprising, these families represent a departure from Intellectual Ventures’ usual business model, as they are the result of a spin-off called Terrapower, a company that has been modernising and building nuclear reactors. As such, it appears that these families were filed to support this product, rather than licensing and litigation.

Most of the top owners are focussed in the Batteries and Photovoltaics classes. This is not a surprise as these are much more commercial than the other technologies. Wind Turbines and Hydroelectric systems tend to be much larger projects that involve government oversight, whereas there are a great variety of opportunities for Batteries and Photovoltaics to be sold on a consumer or industrial market. The key owners for Batteries are Omnitek Partners, and Intellectual Ventures for Photovoltaics.

Graph title: Technology distribution of active families owned by the 5 NPEs with the largest sustainable energy portfolios.

NPEs have litigated against both large and small companies

This analysis has highlighted a few examples of litigations that have occurred in sustainable energy. The technology class with the most litigated families is Batteries, which has also had the most disputes. This has been primarily led by the NPE ‘IP Edge’ which has had 100 disputes with 6 patent families against companies such as Sony, Ricoh, and Duracell. While none of these disputes have not been successful, it still requires companies to redirect resources to fight these claims. While large companies tend to have access to these resources, much of the innovation in sustainable energy comes from small companies who may not be able to repel claims so easily.

Of IP Edge’s 100 litigations, the majority have been against small companies. For example, IP Edge attempted to assert their family titled ‘Discharge Control Circuit Of Batteries’, originally assigned to Fujitsu, against Midnite Solar, a small company with only four patents that manufactures products and accessories for the alternative energy industries. While this dispute was terminated after 7 months, it is a clear example of how NPEs could be stifling innovation in the sustainable energy field. This is just the data for litigations, and there could be many more cases where small companies are coerced into paying licensing fees to NPEs as they are unable to fight them directly, which will also be affecting their ability to innovate.

###

For more information on who owns what and where in the sustainable energy space, access Cipher via your subscription or if you’d like to understand more about the Universal Technology Taxonomy (UTT) used to run this report in Cipher, contact us directly at www.cipher.ai.

Cormac Creagh is a solutions analyst at Cipher, where he works directly with clients to provide insights on patent data. He attended the University of Cambridge, where he graduated with an MSci specialised in Biochemistry. His research interests lie in protein engineering, biofuels, and plant virology. Contact him at cormac.creagh@cipher.ai.