Ken Seddon

The second quarter of 2017 brought us a bang and a fizzle. The bang was the large number of companies joining LOT. Our community continues to grow at a record pace, adding 34 new members including Volkswagen, Vizio, Salesforce, eBay, Net App, Tesla, Electronic Arts, Seagate, Affirm and numerous startups. We now have 159 members and over 749,000 assets in our community.

This growth was fueled in part by the fizzle provided by the Supreme Court’s ruling in TC Heartland. Many had hoped, and some even proclaimed, that TC Heartland would be the end of PAEs in the Eastern District of Texas (EDTX). Now that the EDTX has responded in Raytheon Co. v Cray with an expansive, four-prong test for considering venue, it is clear that PAEs will continue to thrive there. I had the opportunity to speak with Joseph Matal, Interim Director US PTO, who himself even predicted that, “TC Heartland would not be the end of the venue issue.” (Diane Lettelleir of JC Penney digs into the details here.)

Companies of all sizes, and in nearly every industry, realize PAEs are a real threat to their business and are looking to LOT for immunization against this risk. Companies I meet with often ask, “But what if I decide to sell to a PAE in the future?” I remind them that LOT does not affect any of the traditional uses of patents, and that members are free to sell their patents to anyone. In fact, Innography has confirmed that assets from LOT members have fallen into the hands of PAEs.

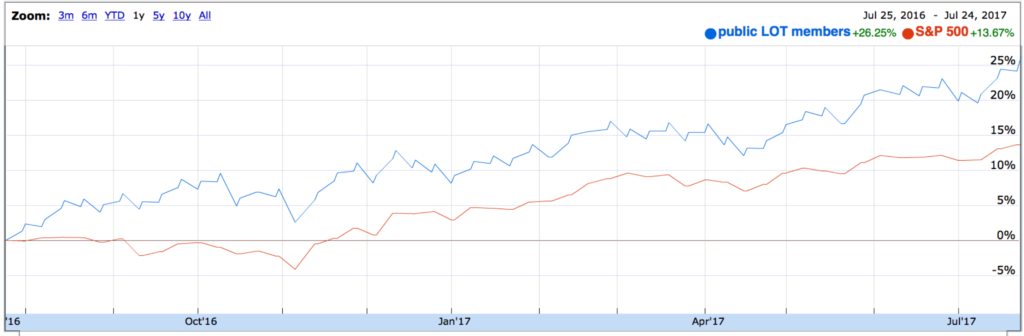

But we also wanted to provide a more satisfying answer for companies who are torn between a) optimizing their IP strategy for success by focusing on risk reduction, or b) optimizing their IP strategy for monetization. The results of our analysis were very surprising: Companies that are in LOT outperform the S&P 500® by 90%, and more importantly, LOT members outperform monetizers by 177%!

We first took all the publicly traded companies in LOT (including the retailers who unfortunately have struggled over the past year) and compared them to the S&P 500®.

LOT Members have outperformed the S&P 500 by 90% in the last year.

LOT Members have outperformed the S&P 500 by 90% in the last year.

We then created a “Monetizers Index” by combining all the most significant IP monetizers over the past few years (e.g. IBM, Philips, Yahoo, Qualcomm, Ericsson, Nokia, Technicolor, Sony, Tivo, and Dolby).

Monetizers lag the S&P500 by 87% in the last year.

Monetizers lag the S&P500 by 87% in the last year.

This is not to say that joining LOT will make your company’s stock go up, but it does highlight a key trait LOT members have in common – they prioritize risk reduction. Clearly the investment community prefers companies who are optimizing their business for success through risk reduction vs. optimizing for monetization to the tune of 177%! Some might say LOT Members are optimists; we call them LOTimists.

I would like to thank Lew Zaretzki of Hamilton IPV for his assistance with this analysis and wish you an enjoyable rest of your summer.